PREDICTIVE DIALING SOFTWARE FOR THE MORTGAGE INDUSTRY

Drastically increase your lead generation while ensuring the best customer service experience.

The Razor Predictive Dialer was designed specifically for the mortgage industry and has grown to include features that mortgage companies need as well as it has expanded to include other industries such as loan modification, charities, political campaigns, and lawn services. Unlike the many other phone dialer software and dialer systems available for the mortgage industry, the Razor Predictive Dialer system is an all encompassing solution. All features come standard with the Razor Predictive Dialer software and there are no hidden fees or up charges.

BENEFITS SUMMARY

- Accelerate the number of leads you generate

- Increased sales revenue

- Improved lead management

- Increased customer satisfaction

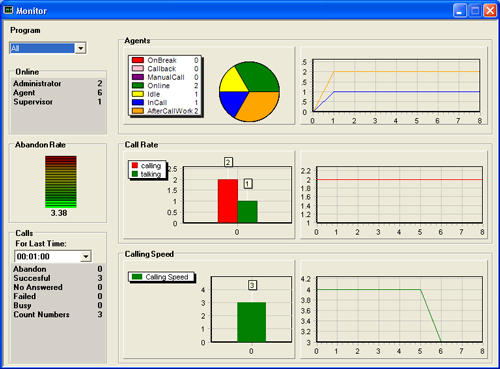

The Razor Predictive Dialer has assisted many companies like yours in the mortgage industry to achieve a 200% increase in qualified lead generation and a 50% increase in sales agent productivity. Using our system, you can achieve these outstanding numbers while enhancing your customer service experience through proper lead management and sales reporting.

BENEFITS EXPANDED

LEAD ACCELERATION

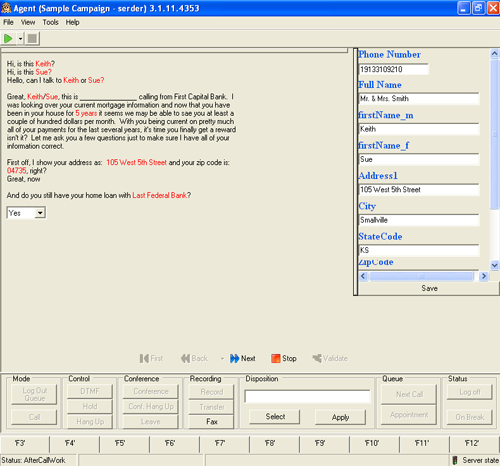

Most mortgage industry calling campaigns start with what we call a ‘First Contact Agent’. These are your telemarketer employees who make first contact with potential leads by using a predictive dialer to automatically call a list of prospects. Manual calling involves having your agents hand-dial calls from a list of numbers you supply them. With a predictive dialer, the calls are made silently until a live person picks up the phone. At that point, the call is instantly connected to an agent. This removes wasted time manually pushing the numbers on the phone, hanging up the receiver, misdialing the number, and since it is automated, it remembers which numbers were disconnected or connected to a fax machine. The number of live prospects is doubled, if not tripled, leading to a 200% or higher increase in qualified leads generated.

SALES REVENUE INCREASED

Anyone in the mortgage industry can tell you that the more prospects you reach, the more qualified leads you will gain. The natural conclusion that any achieving salesperson will reach is that the more qualified leads you are in contact with; the greater number of sales you will close. What if you could double or triple the number of prospects? You would make more sales, wouldn’t you? Time and time again, mortgage companies who use our call center solution see measureable increases in their sales. Typically anywhere from a 50% to a 100% increase can be seen.

LEAD MANAGEMENT ENHANCED

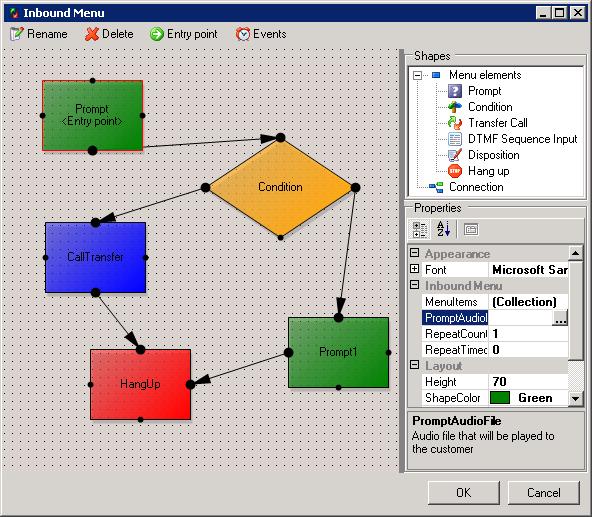

Lead management is an important issue for the mortgage industry. If you are currently manually dialing, chances are you are either hand recording the results on paper worksheets; or perhaps you have a customer relations manager tool. Both methods can lead to incomplete information being recorded, or even worse; lost entirely. With the Razor call center solution, your leads are automatically tracked. Utilizing our powerful branched scripting, answers reporting, and sales reporting tools, your leads are automatically categorized as the calls are made. Furthermore, your sales results are recorded. Virtually all the information you need to properly manage your leads and sales is available at your fingertips through our advanced reporting. All of this comes standard with any Razor predictive dialer purchase!

CUSTOMER SATISFACTION AND LOYALTY

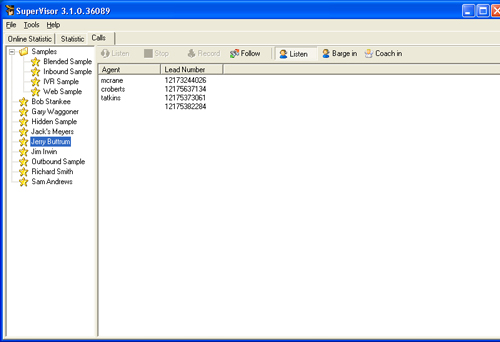

Our call center software is very robust with a multitude of easy-to-use features to monitor and manage your call center. You will be enabled to build lasting, quality relationships with your customers using the reporting features that are inherent to our system. Each and every call made is logged, your agents will have updated customer information available to them each time the speak to a customer, and if you choose; you can even record every conversation. Your agents will be able to serve your customers effectively and efficiently building customer loyalty through improved service.